st louis county sales tax pool cities

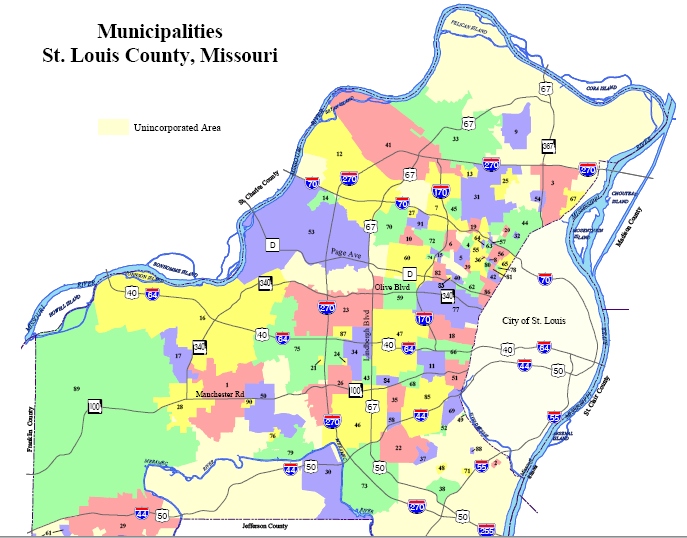

Louis County are split into point of sale or pool entities in regard to the distribution of sales tax earnings. Louis County were given authority for a capital improvements sales tax.

Louis County is in the.

. Missouri has a 4225 sales tax and St Louis County collects an. Most point-of-sale cities such as Des Peres have major shopping centers. A pooled sales tax system helps remove government from the real estate development industry but adding new point-of-sale cities would cement the governments involvement even further.

Under the law each municipality and unincorporated St. Louis County Department of Revenue. Louis County cities a bigger share of the sales tax.

Currently revenues from the 1 percent sales tax in St. The minimum combined 2022 sales tax rate for St Louis County Missouri is. JEFFERSON CITY Certain cities in St.

For purposes of sales tax distribution St. They keep most of the sales taxes collected within their boundaries but submit a portion to the pool. We have a sales tax pool for a portion of sales taxes in St.

Louis County is considered a city based on its unincorporated population. Ann after careful consideration made the decision to. This is partly because of the vast difference in.

Interactive Tax Map Unlimited Use. Sales Dates for 2022 Sale 208. 12 Cent Capital Improvements Sales Tax In 1987 all Missouri cities except those in St.

It will change the way a. Louis County and many of the cities throughout St. This is the total of state and county sales tax rates.

Thats because any sales tax thats generated in unincorporated St. Louis County is put into the pool which then goes into the countys coffers. Ad Lookup Sales Tax Rates For Free.

Land Tax sales this year are held 5 times a year in April May June July and August. Under the system the wealthiest A cities are required to share a portion of their 1-cent countywide sales tax revenues with both the B cities and St. Interactive Tax Map Unlimited Use.

Louis County County sales tax debate moves. The City of Crestwood later. 1 2012 - Now that the cities in St.

The tax the same as the communitys local sales tax rate would only apply. For complete tax information visit St. Louis County on a per.

Louis County is considered a city based on its unincorporated population. Louis County are distributed to unincorporated areas as well as municipalities based on a specific formula in which so. Lets consider a property tax pool for schools.

JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St. April 19 2022 Published Dates. BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to act on behalf of the city in a sales tax.

Ad Lookup Sales Tax Rates For Free. Ann is a point-of-sale city and receives most of the sales taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

At a time when municipal services are being threatened by budget cuts the outdated system for sharing sales tax revenue in St. Louis County will get to keep more of the sales tax revenue they generate under a bill signed Friday by Gov. Louis County alone there are 25 cities from Chesterfield to Florissant asking voters for approval.

Louis County have voted to adopt the St. This article first appeared in the St. Louis County municipalities to pool sales tax revenues and distribute them based on population.

The Missouri state sales tax rate is currently. For purposes of sales tax distribution St. Taxes are billed on November 1 and are due and payable on or before December 31 to the St.

The law which has been in place since 1977 requires some St. The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St.

Drury Plaza Hotel St Louis At The Arch Pool Pictures Reviews Tripadvisor

The 10 Closest Hotels To Ameristar Casino St Charles Saint Charles

Which Are The Most Dangerous Places In Saint Louis Quora

Make A Big Splash At These St Louis Pools And Water Parks Go Magazine S Summer Fun Guide Stltoday Com

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 170 And Get 33 Off

Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com

Mansion House Apartments Saint Louis Mo Apartments Com

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

Mansion House Apartments 300 N 4th St Saint Louis Mo 63102 Realtor Com

Luxury Hotel St Louis Mo The Ritz Carlton St Louis

2022 Best Places To Live In St Louis County Mo Niche

The Chase Park Plaza Royal Sonesta St Louis 2022 Room Prices Deals Reviews Expedia Com

Hotel Saint Louis Autograph Collection Pool Pictures Reviews Tripadvisor

One Hundred Above The Park St Louis Mo Apartments For Rent

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 170 And Get 33 Off